A Brief Outlook of 10 Years Indonesia`s Inflationary Pressure

June 27, 2013 2 Comments

As South East Asia`s largest economy, Indonesia is recently enjoying strong economic growth and betterment of macroeconomic fundamental in response to domestic consumers led-economy. However, there is still main concern now for Indonesia Bank and other emerging-market central banks in balancing their economic growth namely Inflationary pressure which is likely to persist as growth forecasts for this country remains high.

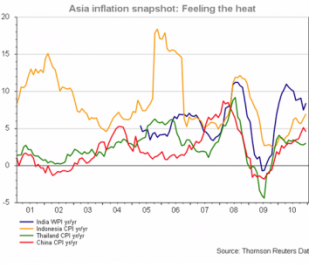

The major issue of 10 years Indonesia`s headline inflation is the domination of the impact of supply side prices, especially from volatile food prices and administered prices. Concerning Rapid growth in the emerging market economy like Indonesia, global commodity prices are greatly essential, driven by food prices, its CPI on average was 13.26 % in the past 10 years (Trading Economics, 2012). Even though there is still huge pressure from commodity prices particularly rising food prices which worsen inflationary expectations in this country, its core inflation which excludes administered prices and volatile foods has been relatively stable below 4 % on average.

In essence, Indonesian government still needs to subsidize energy consumption for its low-income citizens especially gasoline prices, captured in administered prices. Combined with fast growing economy and huge domestic consumption which represents above 60% of GDP, the need of subsidized fuel energy is recently remarkable vital. That is why the global oil prices are one of the major concerns of government. Any further rising oil prices more than $ 100 a barrel, will certainly affect the gap between subsidized and non-subsidized fuel. Because of the huge burden of its subsidized amount on its yearly state budget, for example in 2011 Subsidy Budget was over 230 trillion rupiah, government of Indonesia intentionally plans to raise prices of subsidized fuel by 1,500 rupiah or more and increase electricity tariff up to 10 % in this year (Manurung & Utami, 2012). Many economists calculated that the increase of each 10% of gasoline prices will contribute to around 0.8 % to the inflationary pressure, reflecting scarcity and full-fledged increase in transportation tariffs.

In essence, Indonesian government still needs to subsidize energy consumption for its low-income citizens especially gasoline prices, captured in administered prices. Combined with fast growing economy and huge domestic consumption which represents above 60% of GDP, the need of subsidized fuel energy is recently remarkable vital. That is why the global oil prices are one of the major concerns of government. Any further rising oil prices more than $ 100 a barrel, will certainly affect the gap between subsidized and non-subsidized fuel. Because of the huge burden of its subsidized amount on its yearly state budget, for example in 2011 Subsidy Budget was over 230 trillion rupiah, government of Indonesia intentionally plans to raise prices of subsidized fuel by 1,500 rupiah or more and increase electricity tariff up to 10 % in this year (Manurung & Utami, 2012). Many economists calculated that the increase of each 10% of gasoline prices will contribute to around 0.8 % to the inflationary pressure, reflecting scarcity and full-fledged increase in transportation tariffs.

Furthermore, In focusing on the implementation of a yearly Inflation Targeting Framework ±5%, the central bank of Indonesia has been adjusting BI rate (benchmark rate of Indonesia) as the main monetary policy to control inflation. However, adjusting the BI rate would be more effective if the cause of inflation was coming from the demand side, as demonstrated by a leading economist, John Maynard Keynes. Seems like slightly inappropriate policy, Given that Indonesia’s inflation mostly was driven by cost-push inflation in response to an increase world oil prices lately. Additionally, Bank of Indonesia has increased rupiah minimum reserve requirements (GWM) to 8 percent from the previous level of 5 percent starting on November 2010 (Indriastuti & Mulyadi, 2012), absorbing excess liquidity which can cause inflationary pressure in the past 3 years.

However, to deal with a balance in curbing inflation without stunting economic growth is always tricky for any central bank in the world. In fact, the difficulty of deciding the optimum level of BI rate will be difficult to serve a ‘win-win solution’ for both the real sector and the macroeconomic condition. For one instance, international Indonesian trade side which theoretically has a relationship with the monetary policy. The attached graph shows the inflation has negatively correlation to the trade balance. Dealing with high inflationary pressure in 2001 and the late 2005 which reached 12.55% and 17.07% respectively, the central Bank of Indonesia decided to step up its interest rate to curb this huge inflation and keeping the capital inflow increase at that time. As the result, the strengthening of the rupiah was inevitably, reflecting the increase of the yield of Indonesian 10 year government bond which hit the record to 15% in 2006. Hence adversely impacts to Indonesian exports, lowering the balance of trade and an exact discourage of Indonesia GDP.

However, to deal with a balance in curbing inflation without stunting economic growth is always tricky for any central bank in the world. In fact, the difficulty of deciding the optimum level of BI rate will be difficult to serve a ‘win-win solution’ for both the real sector and the macroeconomic condition. For one instance, international Indonesian trade side which theoretically has a relationship with the monetary policy. The attached graph shows the inflation has negatively correlation to the trade balance. Dealing with high inflationary pressure in 2001 and the late 2005 which reached 12.55% and 17.07% respectively, the central Bank of Indonesia decided to step up its interest rate to curb this huge inflation and keeping the capital inflow increase at that time. As the result, the strengthening of the rupiah was inevitably, reflecting the increase of the yield of Indonesian 10 year government bond which hit the record to 15% in 2006. Hence adversely impacts to Indonesian exports, lowering the balance of trade and an exact discourage of Indonesia GDP.

To sum up, Indonesia`s inflation pressure has been the major concern in today`s economic challenges. The domination of supply side prices in affecting greatly Inflationary pressure especially from global commodity prices volatility have shifted any central banks` policy outlook from fighting inflation to balancing economic growth in emerging countries. Thus, Bank of Indonesia as the main policymakers in regulating monetary policy is facing decisive situation to delay power price hike in this country.

Novan Fernanda

Sampoerna School of Business

Management – Finance 2010

novan.fernanda@student.ssb.ac.id

Indonesia in a problem now. It need the real role of government’s decision and the support of society. It will take a hard debate among them. However, a right decision must be determined as the capability of government.

What do you think about government’s plan to increase fuel price?Is it a right decision to keep inflation to be normal in Indonesia?or it will make depression in inflation?